Search

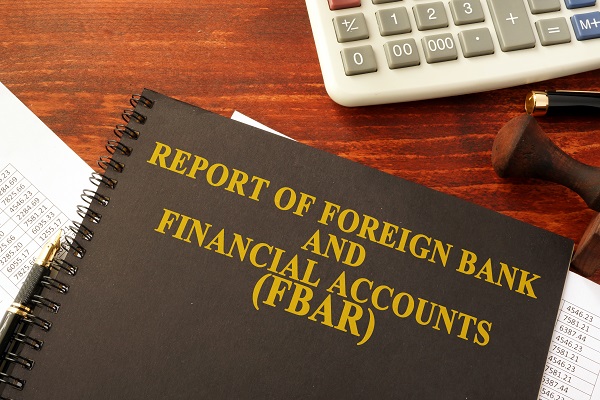

FBARs Are Due on April 15th This Year. Not the Income Tax Filing Deadline of May 17th!

UPDATE: You have until October 15th.

The Internal Revenue Service issued a notice on April 9th reminding U.S. citizens, resident aliens and any domestic legal entity that the deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) is still April 15, 2021. The extension of the federal income tax filing due date and other tax deadlines for individuals to May 17, 2021, does not affect the FBAR requirement.

This could cause many Taxpayers to inadvertently file their FBAR late. The deadline to file the FBAR was changed several years ago to coincide with the deadline for filing individual tax returns in an effort to assist with compliance. With this most recent extension, however, it puts individuals at risk of late filing, since the deadlines are no longer on the same date. Interestingly, in past years the IRS granted an automatic extension of time to file FBARs to October 15th for FBARs, but there is no mention of the automatic extension in the IRS notice.

Tax Problem Attorney Blog

Tax Problem Attorney Blog